Knowing Your Debits From Your Credits

Content

To determine how to classify an account into one of the five elements, the definitions of the five account types must be fully understood. In simplistic terms, this means that Assets are accounts viewed as having a future value to the company (i.e. cash, accounts receivable, equipment, computers). Liabilities, conversely, would include items that are obligations of the company (i.e. loans, accounts payable, mortgages, debts).

This is also known as the Balance Sheet Equation & it forms the basis of the double-entry accounting system. BookkeepingBookkeeping is the day-to-day documentation of a company’s financial transactions.

Why Do Accountants Use T

A subsidiary ledger is a detailed sub set of accounts that contains transaction information. For large scale businesses where many transactions are conducted, it may not be convenient to enter all transactions in the general ledger due to the high volume. In that case, individual transactions are recorded in subsidiary ledgers and the totals are transferred to an account in the general ledger. Subsidiary ledgers can include purchases, payables, receivables, production cost, payroll and any other account type. The key difference between T account and ledger is that T account is a graphical representation of a ledger account whereas ledger is a set financial accounts.

I Want To Spend Half My Paycheck On Rent. Will I Regret It? – Refinery29

I Want To Spend Half My Paycheck On Rent. Will I Regret It?.

Posted: Wed, 01 Dec 2021 18:00:00 GMT [source]

On January 3, 2019, issues $20,000 shares of common stock for cash. Frederick Taylor was an engineer and inventor who developed the theory of scientific management. Learn about Taylor, explore his theories and principles, and understand his contributions to modern management practices. Review the four main principles of scientific management theory, and recognize how these have influenced present-day industrial processes. Explore the concepts of order winners and order qualifiers by studying examples of each. Ann Deiterich has been a writer since 1984 in business-to-business communications, specializing in TQM, business/financial topics, office management and production efficiency. As an environmental proponent, nature and science are her areas of interest.

Boundless Accounting

This system is still the fundamental system in use by modern bookkeepers. Is expected to be debited since it is a liability account. For example, a company’s checking account has a credit balance if the account is overdrawn. ABC Company had accounts payable of $110,000 at the beginning of the year. In this article, we discuss what T-accounts are, how they work, some examples of what a T-account looks like and how to use one for your business’ bookkeeping. Common stock is a type of security that represents ownership of equity in a company.

- The last piece of your transaction is to record the 25,000 dollars your business borrowed to purchase the truck.

- Note that debits are always listed first and on the left side of the table, while credits are listed on the right.

- All increases to Accounts Receivable are placed on the debit side .

- You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account.

A T-account is a demonstration of a general ledger account in visual form. It’s ours; therefore, from the bank’s perspective the deposit is viewed as a liability .

Accountingtools

Here is a closer look at the T-accounts for the primary components of the statement of financial position or balance sheet, namely assets, liabilities, and shareholder’s equity. The ledger journal of individual accounts has a T-shaped look, which is the reason a ledger account is sometimes known as a T-account. For a better conceptual understanding of debits and credits, let us look at the meaning of the original Latin words. The English translators took theirs word credit and debit from the Latin words credre and debere, respectively. ” When we look closely into these two concepts we see that they are actually two sides of the same coin. In a closed financial system, money cannot just materialize.

- Every business transaction is record with debit and credit as per rules of accounting.

- Transactions include sales, purchases, receipts, and payments made by an individual or organization.

- So, to increase the asset account balance, we will debit it.

- The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000.

- All debits fall on the left side of the T-account and credits fall on the right side, eventually balancing out at the bottom of the ledger.

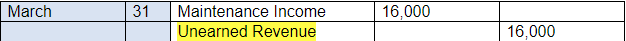

Account adjustments are entries out of internal transactions within a business, which are entered into the general journal at the end t account definition of an accounting period. Learn about their different types, purposes, and their link to financial statements, and see some examples.

5 Use Journal Entries To Record Transactions And Post To T

On the other hand, increases in revenue, liability or equity accounts are credits or right side entries, and decreases are left side entries or debits. The visualization of the business transactions of any organization is done by writing a general journal entry.

Earning a revenue of $10,500 will increase the asset account balance. So, to increase the asset account balance, we will debit it.

Increase And Decrease In T Account Balances

It is not taken from previous examples but is intended to stand alone. The law of diminishing returns states that there is a point at which output begins to decrease as the input variable increases. Study the definition of the law of diminishing returns and examples of this concept. Note that debits are always listed first and on the left side of the table, while credits are listed on the right.

@sp_meg non mais laisse t'a raison. On vit dans un pays raciste. par définition le racisme est banalisé. #SPACEAFROOO pic.twitter.com/XaeHfmgJCR

— r*r a hate account ✨ (@uncorgito) November 24, 2021

Since the company is now paying off the debt it owes, this will decrease Accounts Payable. Liabilities decrease on the debit side; therefore, Accounts Payable will decrease on the debit side by $3,500. Cash is decreasing because it was used to pay for the outstanding liability created on January 5. This is a transaction that needs to be recorded, as Printing Plus has received money, and the stockholders have invested in the firm.

Types Of Accounts In Accounting:

However, in practice, bookkeepers do not normally show the terms debit or Credit at the top of the accounts as there is no need to give them a reminder about these rules. An account’s balance is the amount of money in that account at a particular point of time. In a T- account, we show the balance of an account for the beginning of a period and the end of the period. To provide a clear record of all the transactions and all the accounts. To teach accounting since a T account clearly explains the flow of transactions through accounts. This means you have an increase in the total amount of gas expense for April.

Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Taking $500 out from the business will decrease the bank account balance. Credit accounts payable to increase the total in the account.

Another key element to understanding the general ledger, and the third step in the accounting cycle, is how to calculate balances in ledger accounts. Recall that the general ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming.

What Is Profit & Loss Appropriation Account?

Purchasing refers to a business or organization acquiring goods or services to accomplish the goals of its enterprise. This transaction results in a decrease in the finances of the purchaser and an increase in the benefits of the sellers. As credit purchases are made, accounts payable will increase. In the journal entries, the credit side always appears on the right side of a journal format. This is because the credit in the owner’s equity, liabilities and revenue account may increase them and debit in such accounts may decrease them. In a T-shaped account, there is the number of transactions on the debit and the credit side.

Et si t’es pas d’accord tu es d’extrême droite, un nazi qui mange des chatons qui n’y connais rien en science sociale. Perso je pense bcp à Denis Colombi qui est le pro pour changer des définitions à sa guise, te sortir des articles inaccessibles, qui sort des énormités

— Élie. (Orelsan fanboy account) (@senorelrab) November 25, 2021

Each transaction (let’s say $100) is recorded by a debit entry of $100 in one account, and a credit entry of $100 in another account. When people say that “debits must equal credits” they do not mean that the two columns of any ledger account must be equal. If that were the case, every account would have a zero balance , which is often not the case. The rule that total debits equal the total credits applies when all accounts are totaled.

- This money will be received in the future, increasing Accounts Receivable.

- Obviously, it would be pretty difficult to search through 1,000 pages in order to find information about one account.

- The record is placed on the credit side of the Service Revenue T-account underneath the January 17 record.

- As they look like the capital letter “T” so are called “T” accounts.

- For all the asset accounts, which includes cash, accounts receivable, property, plant, and equipment, etc., an entry in the left side of the T means an increase in that accounts balance.

The next transaction figure of $300 is added on the credit side. Checking to make sure the final balance figure is correct; one can review the figures in the debit and credit columns. In the debit column for this cash account, we see that the total is $32,300 (20,000 + 4,000 + 2,800 + 5,500). The credit column totals $7,500 (300 + 100 + 3,500 + 3,600). The difference between the debit and credit totals is $24,800 (32,300 – 7,500).

Accounts Payable 50, ,000 80,000 50, , ,000 Liabilities normally have credit balances. Since Accounts Payable are liabilities, all increases are place on the credit side while all decreases are place on the debit side. Total debits amount to $190,000 while total credits amount to $50,000. The balance of Accounts Payable is computed by getting the difference which is equal to $170,000. The right side is conversely, a decrease to the asset account. For liabilities and equity accounts, however, debits always signify a decrease to the account, while credits always signify an increase to the account. This can cause a company’s general ledger to not balance.

Author: Kate Rooney