Retail foreign exchange trading

Contents

Welcome, we’ll show you how forex works and why you should trade it. Your FOREX.com what are spinning tops forex account gives you access to our full suite of downloadable, web, and mobile apps.

Can currency trading make money?

Key Takeaways

It is possible to make money trading money when the prices of foreign currencies rise and fall. Currencies are traded in pairs. Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage.

Well, as we’ve explained already education is of utmost important when you’re starting to trade. So, we’d recommend websites like Baby Pips, which has a whole ‘School of Pipsology’ designed to help you learn the art of forex trading. Fixed spreads are generally provided by brokers that are defined as ‘market makers’.

Currencies are traded on the Foreign Exchange market, also known as Forex. This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. The Forex market remains open around the world for 24 hours a day with the exception of weekends.

Overview of different currency pairs across forex trading, as well as their nicknames used in the market

They are the most basic and common type of chart used by forex traders. They display the closing trading price for the currency for the time periods specified by the user. The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information contained in a trend line to identify breakouts or a change in trend for rising or declining prices. In a swing trade, the trader holds the position for a period longer than a day; i.e., they may hold the position for days or weeks. Swing trades can be useful during major announcements by governments or times of economic tumult.

Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. Take control of your trading with powerful trading platforms and resources designed to give you an edge. You can spread bet from £0.30/point on EUR/USD, GBP/USD, USD/JPY and AUD/USD, and £0.40/point on EUR/GBP. You can see the minimum trade size for all instruments on the platform, in ‘Product overview’, under ‘Betting and Position Limits’. Invest in online equity trading in 25 countries and exchanges in 16 currencies.

Instead of executing a trade now, forex traders can also enter into a binding contract with another trader and lock in an exchange rate for an agreed upon amount of currency on a future date. Most forex trades aren’t made for the purpose of exchanging currencies but rather to speculate about future price movements, much like you would with stock trading. A vast majority of trade activity in the forex market occurs between institutional traders, such as people who work for banks, fund managers and multinational corporations. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations.

The Forex Market: Opening Times

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Zero in on price action with our clean, fast charts, deepen your analysis with advanced ProRealTime and Autochartist packages. Currency trading is a 24-hour market that is only closed from Friday evening to Sunday evening, but the 24-hour trading sessions are misleading. There are three sessions that include the European, Asian, and United States trading sessions.

Trade on 60+ Forex Pairs With Leverage

Open an account quickly and easily – you could be set up and trading forex today. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. A standard lot is the equivalent of 100,000 units of the base currency in a forex trade. It is one of the three lot sizes; the other two are mini-lot and micro-lot.

You will also need to apply for, and be approved for, margin privileges in your account. It’s a global market for exchanging currency between nations, and for individual speculators or traders. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. As with other assets , exchange rates are determined by the maximum amount that buyers are willing to pay for a currency and the minimum amount that sellers require to sell . The difference between these two amounts, and the value trades ultimately will get executed at, is the bid-ask spread. FXTM gives you access to trading forex as you can execute your buy and sell orders on their trading platforms.

You will see the country’s exchange, the company’s name, the real-time quote, currency, and the market status . In the window that opens, in the Search field, enter the company’s name. A page displays showing the stock and all of the exchanges it’s traded on. Share prices were mixed in Asia on Friday after China reported its economy contracted by 2.6% in the last quarter as virus shutdowns kept businesses closed and people at home.

Setting up an account

As technology has developed though, smaller investors like individual traders can now access the market and become retail traders! So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other. As we discussed before, when you’re going to be trading forex you’ll need to understand how currencies are actually priced. We know that currencies are actually traded in pairs; with the value of one currency appreciating or depreciating in value against the other. On any given day, the pound might be rising against the dollar, while the euro falls against the Swiss franc.

What is an online currency trader?

What is forex trading? Forex trading involves the speculative buying and selling of currencies in quest of profit. It can also be used to 'hedge' existing currency bets against a backdrop of exchange rate fluctuations. (Hedging is where you protect a financial position against the potential of making a loss.)

These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar. The first step to forex trading is to educate yourself about the market’s operations and terminology. Next, you need to develop a trading strategy based on your finances and risk tolerance. Today, it is easier than ever forex axiory reputation to open and fund a forex account online and begin trading currencies. Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The currency forwards and futures markets can offer protection against risk when trading currencies.

CompareForexBrokers found that, on average, 71% of retail FX traders lost money. This makes forex trading a strategy often best left to the professionals. The forex market is open 24 hours a day, five days a week, which gives traders in this market the opportunity to react to news that might not affect the stock market until much later. Because so much of currency trading focuses on speculation or hedging, it’s important for traders to be up to speed on the dynamics that could cause sharp spikes in currencies.

She has published personal finance articles and product reviews covering mortgages, home buying, and foreclosure. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. Build your confidence and knowledge with a wealth of educational tools and online resources. Stay informed with real-time market insights, actionable trade ideas and professional guidance. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

What is the Spread?

Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. James Chen, CMT is an expert trader, investment adviser, and global market strategist. A forex trader effectively creates a ‘hedge’ where they protect a position they already have from an undesired move in the market. What they will do is hold both a ‘long’ and ‘short’ position at the same time using the same currency pair. Also known as the ‘perfect hedge’ this method effectively eliminates all risk from the position while the hedge is active. So, when the market starts to move in one direction and the trade is sure that it’ll continue along that path, they’ll close the trade in the opposite direction.

Developing solid trading habits, attending expert webinars and continuing your market education are a few ways to remain competitive in the fast-paced forex environment. There are several key differences between swapping currencies abroad and buying or selling forex. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Sign Up NowGet this delivered to your inbox, and more info about our products and services. The EURO in the last sessions starts to recover its value after a long Bearish momentum, it’s normal for the market to recover breath after a so-long drop.

Next, nearly all currencies are priced out to the fourth decimal point. Although there is some overlap in the sessions, the main currencies in each market are traded mostly during those market hours. This means that certain currency pairs will have more volume during certain sessions. Traders who stay with pairs based on the dollar will find the most volume in the U.S. trading session.

One critical feature of the forex market is that there is no central marketplace or exchange in a central location, as all trading is done electronically via computer networks. Get increased control over your forex CFD trades with our DMA platform. Build forex trading algorithms to execute automatically, even if your machine is off.

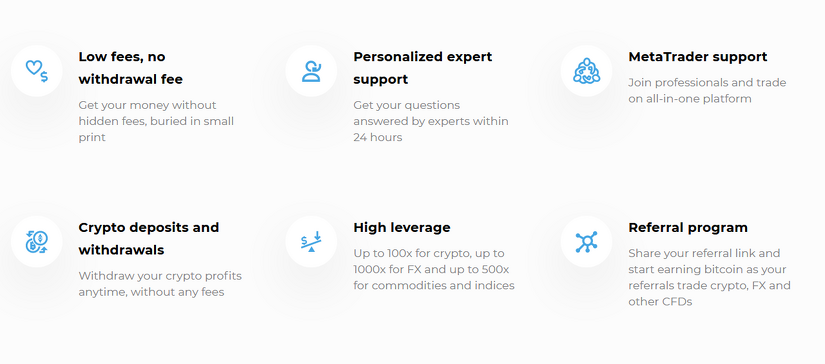

A great risk management tool, offered on easyMarkets Proprietary Platform and Apps at no additional charge. Axi charges no fees for funding and withdrawals to your trading account. We implement high industry standards of encryption to ensure your account is fully protected. A lot of the process can be automated which means you’ll have more time for your analysis.

In other words, you trade the EUR/USD currency pair – not the EUR or the USD. No other market can compare to the sheer value of this massively traded market. Estimates peg the value of Forex trading at around $5-$7 trillion per day, a figure that far outstrips the value of all stock market trading in the world.

The base is always expressed first and the counter second – so in our example, the EUR is the base currency and the USD is the counter. If traders are positive on the prospects for the Yen, they would expect overall number to go down – i.e. the Yen would be getting stronger against the Dollar. Traders would be buying less Yen with a Dollar as the Yen got stronger. Similarly, if the Yen was expected to weaken, forex traders would expect the Yen number to go up, reflecting the fact that the dollar could buy more yen. Central banks – These can have a big influence over the performance of currencies, for example by changing interest rates or printing more money. Central banks can also buy and sell their own currency in order to keep it trading within a certain level.

On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses. The foreign exchange market refers to the global marketplace where banks, institutions and investors trade and speculate on national currencies. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The exchange of foreign currencies goes back to early human civilization and the advent of trade routes and commerce.

Professional FX Trading Tools

The value of each currency depends on the supply and demand for it, thus determining the ‘exchange rate’ between the two currencies. The exchange rate itself is basically the difference between the value of one currency against another. And, it’s this exchange rate that determines how much of one currency you get in exchange for another, e.g. how many Pounds you get for your Euros. This means that when you’re trading, the profit that you made on a trade is actually amplified because you’re using more money to trade that you have effectively borrowed from you broker. At this point you should be hugely aware that trading with leverage is a double-edge sword. Although your profits may be amplified, your losses are also amplified.

The timeframes that traders tend to use will range from really short term or over the course of a few hours. Well, some key factors to consider are your risk tolerance and trading style. For example, traders that are looking to make long-term investments over a period of years would be more suited to stocks. While those who are more interested in shorter-term investments with higher risks involved may be more suited to forex investing.

However, due to the heavy use of leverage in forex trades, developing countries like India and China have restrictions on the firms and capital to be used in forex trading. The Financial Conduct Authority is responsible for monitoring and regulating forex trades in the United Kingdom. A scalp trade consists of positions held for seconds or minutes at most, and the profit amounts are restricted in terms of the number of pips. Such trades are supposed to be cumulative, meaning that small profits made in each individual trade add up to a tidy amount at the end of a day or time period. They rely on the predictability of price swings and cannot handle much volatility.

However, the trading volumes for forex spot markets received a boost with the advent of electronic trading and the proliferation of forex brokers. Currencies are important bull flag chart because they allow us to purchase goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business.